A lot of our clients in the fintech space often start their discovery and idea validation sessions by mentioning Tabby UAE. Fintech is one of the most sensitive yet lucrative app development domains across the globe. And with Middle East, fintech becomes a lot more interesting because of the cultural considerations around money lending, debt, and repayments. In such demographics, Tabby UAE app has absolutely proven a game-changer. In the consumer finances, Tabby, an emerging yet successful example of the Buy Now Pay Later business model, represents a case study for app developers. With a $200M in series D funding, this fintech app is valued at $1.5B in the UAE.

What is Tabby app?

Tabby is a BNPL app that has combined financial technology with user-centric design to create a service that meets contemporary consumer needs while driving merchant sales and customer loyalty – with interest-free installments in the middle eastern market – a location that has high tech acceptance for new mobile apps.

To help all inspired app founders, this article covers:

- The basic business model of Tabby UAE

- How Tabby payments work

- How does Tabby make money

- The technology stack of Tabby

- The key features, User Interface and security measures of Tabby

- Marketing and user acquisition strategies of Tabby app

- Tabby’s role in fintech and BNPL market of Middle East

What is Tabby UAE?

Tabby UAE is a leading fintech company that’s revolutionizing the shopping experience by offering “buy now, pay later” (BNPL) services.

Established to cater to the growing demand for flexible payment options, Tabby allows consumers to make purchases and split the cost into interest-free installments. This model has quickly gained traction, particularly in the Middle Eastern markets of the United Arab Emirates and Saudi Arabia, where consumer preferences are rapidly evolving towards more convenient and user-friendly financial solutions – but ones that are interest-free because of cultural considerations.

Tabby’s platform seamlessly integrates with both online and brick-and-mortar retailers, provides a versatile solution that enhances the shopping experience. The service is super user-centric, offer instant approval without lengthy credit checks and the Tabby, as a mobile app, is accessible to a broader audience. Users can manage their payments through a simple and intuitive mobile application, which tracks their spending and payment schedules.

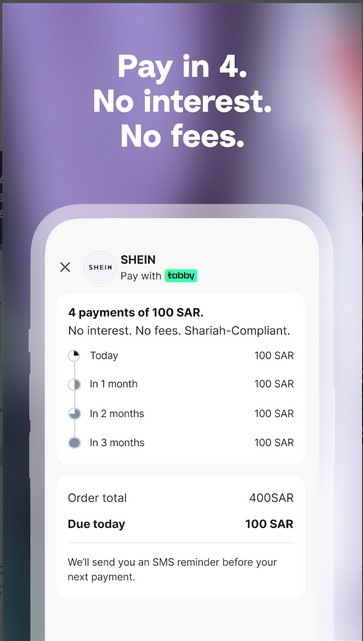

How do Tabby payments work?

Tabby operates by offering consumers the flexibility to make purchases and pay for them in interest-free installments. This way, the Tabby UAE app enhances the shopping experience and financial management.

When a consumer shops at a partner retailer, either online or in-store, they can choose Tabby as their payment method at checkout. The user is then presented with the option to split their purchase into several installments, typically over a few months. This process is exceptionally user-friendly because of the instant credit assessment conducted using minimal information such as a phone number and ID.

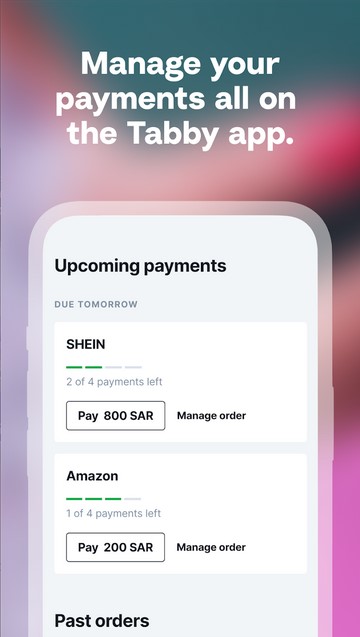

Upon approval, the consumer is informed of their payment schedule, which can be easily managed through the Tabby app, where they receive reminders and can track their spending and upcoming payments.

For retailers, integrating Tabby into their payment systems can drive higher sales and increase average order values by offering customers a more flexible payment option.

Tabby provides comprehensive APIs and SDKs to facilitate easy integration. Additionally, the platform’s technology stack is designed to handle high transaction volumes, which means shops and vendors can practice scalability and consistent performance.

Tabby helps retailers because the ‘Buy now, pay later’ option improves reduced cart abandonment rates and enhances customer satisfaction.

Meanwhile, Tabby doesn’t charge upfront to end-user, and generates revenue through merchant fees and, when applicable, late fees.

This win-win model makes Tabby payments a compelling choice for both consumers seeking financial flexibility and retailers aiming to boost sales and customer loyalty.

Key Features of Tabby UAE Mobile App

-

Payment reminders

The app sends automatic notifications to remind users of upcoming installment payments. This feature helps users stay on track with their payment schedules and avoid late fees.

-

Ecommerce integration

The Tabby app integrates with various e-commerce platforms like Amazon so users can shop at partner retailers and select Tabby as their payment method directly at checkout.

-

Spend tracking

Users can track their spending through the app, with detailed insights into their purchase history and upcoming payments.

-

Analytics

The app provides quick analytics to users about their spending patterns – so they know where and how to spend in future. For retailers and vendors, the app provides analytics about payment receipts and Tabby-supported sales.

-

In-app support

The app offers 24/7 live chat support so users can get assistance about payments, repayments or other app-related issues instantly.

Key Features of Tabby UAE Business Model

-

Interest-free installments

Consumers can split their purchase amounts into manageable installments without incurring interest, provided payments are made on time.

-

Instant approval process

The approval process is streamlined and quick, minimizing barriers to purchase and enhancing the user experience.

-

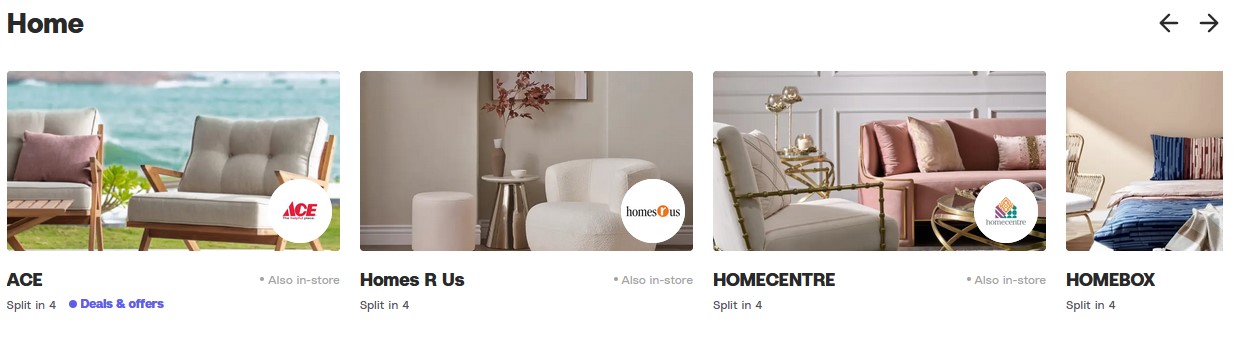

Retailer partnerships

Tabby partners with a wide range of retailers, from major e-commerce platforms to local stores, expanding its reach and utility.

How Tabby payments work for users

Tabby’s payment system simplifies and enhances the purchasing process for consumers, provides a flexible alternative to traditional payment methods. Here’s a quick overview of how Tabby payments work:

- As mentioned earlier, Tabby’s system performs an instant credit assessment using minimal data, such as a phone number and ID. This process, quick and user-friendly, minimizes the friction at the point of sale.

- Upon approval, consumers are informed of their payment schedule, which is also accessible through the Tabby app.

- The app sends reminders to ensure timely payments and helps users stay on track.

- Through the Tabby app, users can monitor their spending, view upcoming payments, and manage their account settings.

If you are an app founder, I’ll highlight that the simplicity and efficiency of Tabby’s payment process, its user-centric design and integration has made it a compelling fintech solution highly acceptable throughout UAE and Saudi Arabia.

How does Tabby make money?

Now this is one of the most common questions my organization receives from aspiring app founders – they are always curious about Tabby’s monetization – because if Tabby UAE provides interest-free loans, how is it operating so profitably and attracting global attention from giant fintech solutions like PayPal.

The product development strategists at CMOLDS conducted a thorough teardown of Tabby payments and came up with the information on Tabby’s multifaceted money-making strategy which generates revenue all while providing value to both consumers and retailers.

Here are the primary ways Tabby makes money:

-

Merchant fees

Retailers who partner with Tabby pay a fee for each transaction processed through the platform.

This fee is typically a percentage of the sale and is justified by the increased sales and higher average order values that Tabby’s payment options facilitate.

Retailers benefit from reduced cart abandonment rates and a more attractive shopping experience for customers and so, they are happily paying this merchant fees to Tabby.

-

Late fees

While Tabby offers interest-free installments, it imposes late fees on consumers who fail to make their payments on time.

While these fees incentivize the timely payments, they also serve as an additional revenue stream for the company so it doesn’t have to bear the opportunity cost of the money foregone.

However, Tabby’s primary focus remains on providing a positive user experience, so late fees are structured to be fair and transparent – and are clearly displayed in the Tabby mobile app.

-

Data monetization

With users’ consent, Tabby also leverages the data generated from its platform to gain insights into consumer behavior and preferences.

While Tabby primarily uses this data to improve services and tailor marketing strategies, it also holds potential for monetization through strategic partnerships and targeted advertising.

-

Tabby+

Tabby+ is a subscription service that helps premium users pay for groceries, utilities, fuel, food delivery apps in 4 installments. Tabby+ comes for 49 AED per month with a free trial period of 30 days.

The Technology Stack of Tabby Payments

Tabby’s robust technology infrastructure is central to its success because it enables:

- seamless transactions

- real-time credit assessments

- secure user experience

The Tabby app’s technical architecture is scalable, flexible, and secure enough to address the diverse needs of consumers and retailers. It handles high transaction volumes, accommodates the rapid growth in user base and transaction frequency. The use of microservices architecture allows for independent scaling of different components, while the performance remains consistent even during peak usage.

Its development stack is a combination of:

- strong backend that utilizes Google Cloud Platform for necessary computational power and storage capabilities

- solid frontend on popular framework React Native for the mobile app for a responsive and consistent user experience across devices

- Machine learning algorithms for instant credit assessments that analyze user data in real-time and make accurate credit decisions

- APIs and SDKs to easily embed Tabby’s payment options into the checkout processes for online and in-store vendors

- Security protocols including encryption, multi-factor authentication, and continuous monitoring for fraud detection and regulatory compliance

Recommended Read: How much does it cost to develop an app in Dubai

Tabby UAE App’s User Experience and Interface Design

As an app experience enthusiast, I will attribute Tabby payments’ success to its exceptional user experience (UX) and interface design. The founder and their app development teams have prioritized an intuitive, smooth and engaging user journey to outrun competitors like Cashew payments, Postpay and Tamara in the middle-eastern fintech ecosystem.

User Interface

Tabby’s user interface (UI) is clean and straightforward, and presents a shallow learning curve for new users. The app’s layout is intuitive, with clear navigation paths that guide users through the various functionalities, from browsing retailers to managing payments.

User Onboarding

The onboarding process for new users in Tabby app is quick and hassle-free and requires only minimal information for account setup.

This frictionless entry retains potential users who might be deterred by lengthy registration processes. Instant credit assessment further enhances the onboarding experience and users can start shopping with Tabby almost immediately after download.

Branding

Tabby maintains a consistent visual identity across all touchpoints, reinforces brand recognition and trust.

The use of consistent color schemes, typography, and iconography gives the Tabby app cohesive look and feel like its card, enhances user confidence in the platform.

User-Centric Features

The app includes features such as payment reminders, spending trackers, and detailed transaction histories to provide users with control over their finances.

Accessibility

Tabby is available for Android and Apple (iOS) mobile users. It has features such as scalable text, voice guidance, and high-contrast modes that cater to diverse user needs.

Is Tabby Safe – App Security and Compliance

In the fintech industry, security and compliance are paramount, and Tabby places a strong emphasis on these aspects to protect its users and retailers.

Robust Security Measures

Tabby UAE implements comprehensive security protocols to safeguard user data and transaction integrity. This includes:

- End-to-end encryption that protects sensitive information during transmission and storage

- Multi-factor authentication (MFA) that requires users to verify their identity through multiple means before accessing their accounts.

Fraud Detection and Prevention

Leveraging machine learning algorithms, Tabby continuously monitors transactions for unusual activity that could indicate fraud.

These algorithms analyze patterns and detect anomalies in real-time for immediate action to prevent potential fraud.

Compliance with Regulations

Tabby adheres to stringent financial regulations and industry standards, including the Payment Card Industry Data Security Standard (PCI-DSS).

Tabby payments meet the required benchmarks for data protection and transaction security. The app’s development teams perform regular audits and assessments to maintain compliance and address any potential vulnerabilities.

User Privacy

The platform minimizes data collection, only gathers information necessary for service provision and credit assessment. Transparent privacy policies inform users about how their data is used and protected.

Marketing and User Acquisition Strategies

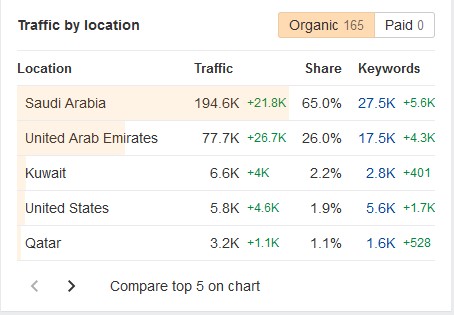

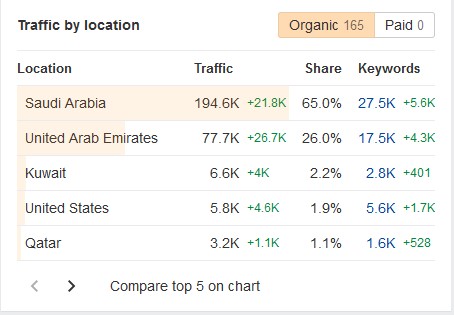

With problem-solving technology and user-friendly design, Tabby UAE also achieved success because of its strategic marketing and user acquisition efforts. According to its co-founder Hosam Arab, Tabby is destined to redefine and reshape the consumer financial ecosystem. And undeniable, Tabby has become a strong force in the middle east. Their user acquisition strategy has strong marketing pillars:

Targeted Advertising and Branding

Tabby employs targeted advertising to reach potential users via Google Ads, Facebook, and Instagram. Additionally, Tabby has created enough collaterals to rank on brand-led SEO terms.

Partnerships and Collaborations

Tabby UAE has made strategic partnerships and brand affiliations with popular names including H&M, Adidas, IKEA, SHEIN, noon, and Bloomingdale.

Content Marketing and SEO

Content Marketing and SEO

The app founders have invested in content marketing to educate potential users and establish Tabby as a thought leader in the fintech space. Additionally, a strong focus on search engine optimization (SEO) has helped Tabby rank highly on relevant search queries and drive organic traffic for target locations.

Referral Programs and Incentives

To encourage word-of-mouth marketing, Tabby offers referral programs that reward users for bringing new customers to the platform.

Incentives such as discounts or cashback on first purchases make the referral process attractive, and encourage existing users to expand the customer base.

Tabby’s Future Revenue Potential in The BNPL Market of Dubai

The “buy now, pay later” (BNPL) sector is poised for significant growth in the Middle East. It is impacting consumer preferences and choice of brands. In this hot market, Tabby is a key player. Here are 4 mind-blowing statistics that emphasize Tabby’s role in the Buy Now Pay Later consumer financial market:

- UAE is expected to become fully cashless by 2030.

- According to GlobeNewsWire, the Buy Now Pay Later market of UAE is estimated at 3 billion USD, with potential to grow up to 5.1 billion USD in 2029.

- The market is forecasted to experience a Compound Annual Growth Rate of 10.8% after 2024.

- More than 7% of Middle Eastern websites[ offer BNPL payment methods.

Key Players in The Buy Now Pay Later Industry of UAE

The main competitors of Tabby in the UAE fintech market are Postpay, Spotii, Tamara and Cashew.

Recommended read: Mobile App Competitor Analysis Checklist

Fintech App Development in Dubai with CMOLDS UAE

So this comprehensive case study on Tabby UAE concludes here – but this is your lightbulb moment towards one of the most financially rewarding ventures. In a billion-dollar industry, app founders in the fintech space, specially in the BNPL domain can enjoy a substantial chunk of users, brand loyalty and revenue.

If you too are an aspiring app founder impressed by the journey and user acquisition strategies of Tabby, you have taken your first step forward. As an app development company in Dubai, we have built 126 mobile applications that are reshaping the user experiences in their niche and we are working on 12 more. We have been in Dubai for 30 years and know the pulse of this market. With a brilliant app development idea, if you want right execution for your vision, CMOLDS is the strategic partner you need. We provide full-cycle app development support from discovery to design, development, testing, deployment and market entry with our network of venture capitalists and investors.

And if this excites you, let’s book a FREE ideal validation session with Muhammad Saud, our senior product development strategist who’ll brainstorm the features, level of effort, timeline and app development investments you’ll need to bring your vision to reality.

FAQs

Which is the best Tabby Alternative in UAE?

Here are five “buy now, pay later” (BNPL) alternatives to Tabby that operate exclusively in the UAE:

- Postpay: A popular BNPL service in the UAE, Postpay allows consumers to split their purchases into interest-free installments. It partners with a variety of retailers and offers flexible payment options both online and in-store.

- Spotii: Spotii is another prominent BNPL provider in the UAE and offers consumers the ability to pay for their purchases in four equal, interest-free installments. Spotii aims to create a more inclusive and accessible shopping experience by partnering with numerous retailers across the region.

- Tamara: While Tamara operates in several Middle Eastern countries, it has a significant presence in the UAE. It provides BNPL services that allow customers to split their payments into three installments without any interest or fees, provided they pay on time.

- Cashew Payments: Cashew offers a BNPL service that is available in the UAE and enables consumers to divide their purchases into manageable installments. Cashew Payments focuses on providing a seamless shopping experience and partners with a range of local and international retailers.

Shahry: Shahry is a BNPL service tailored for the UAE market that allows consumers to buy now and pay later through flexible installment plans. Shahry works with various retailers to provide a convenient and accessible payment solution for its users.